Bank Of Baroda Fixed Deposit Interest Rate

- What Is The Interest Rate On Fd In Bank Of Baroda

- Bank Of Baroda Interest Rate

- Bank Of Baroda Fixed Deposit Interest Rate Calculator

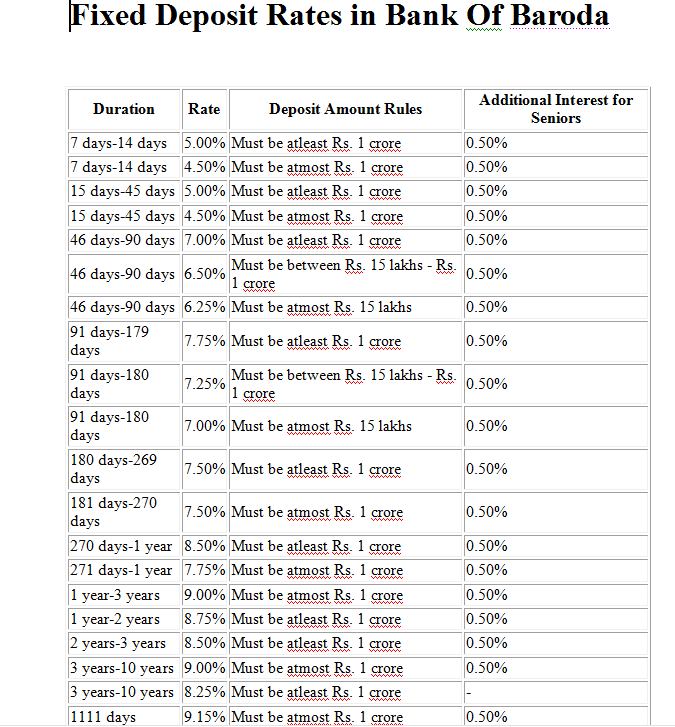

The fd rates in Bank of Baroda is at a minimum of 2.90% per annum, while this rate goes up to 5.30% per annum. As for the fixed deposit in Bank of Baroda, it can go above Rs.10 crores to Rs.25 crores for domestic investors. Features of Bank of Baroda Fixed Deposit Investment Amount Minimum - Rs. 15,01,000 Maximum- Rs. For Baroda Advantage Fixed Deposit (domestic) Accounts (Non Callable)(Deposit amount: Rs. And above) Non-Callable Bulk deposits of Rs.2.00 crore and above will also have additional interest upto 10 bps over the applicable rate of interest for Normal Bulk Deposits (callable) as per the maturity period of deposits as decided by The Treasury Department, BCC.

The minimum deposit is Rs. 1000 and the maximum deposit is Rs. You can deposit in multiples of Rs. The bank pays 0.5% additional interest for senior citizens. The staff and pensioners of SBI will get additional 1% interest rate. ICICI Bank - You can opt for a fixed deposit which pays interest on monthly or quarterly basis. The latest FD rates on SBI deposits is effective from 10th January 2020. The bank has cut the FD rates by 15 bps on long-term deposits maturing in 1 year to 10 years. Now FD interest rate for 7 to 45 days is 4.50%, for 46 to 179 days is 5.50%, for 180 days to 1 year is 5.80% and for 1 year to 10 years is 6.10%. Loan against deposit provided on demand up to 95% of deposit amount without any guarantor. In case of premature payment, the deposit has to run for a minimum period of three months to earn interest. In case it has run for more than three months, interest @ 1% below the rate applicable for the period deposit has run with the banks will be paid.

DepositAdminBank of Baroda (Botswana) Ltd offers various deposit plans that you can choose from depending on the term period, nature of deposit and its unique saving and withdrawal features.

Apart from competitive interest rates and convenient withdrawal options, our deposit plans offer other features such as cheque book facility in all current accounts and Saving products, sweep in and sweep out from current to call and vice versa , accounts of individuals etc.

Select from following products:

Fixed Deposit AccountThis product is available for the deposit holders to keep fixed sum of money for a definite period of time at a fixed rate of interest

- Eligibility:

Individuals, business firms, company, association, society etc. - Deposit amount:

Minimum P500

Maximum No Limit - Period :

Minimum 1 month

Maximum 36 month - Rate of interest:

As applicable in deposit rates for one month and other periodic slots from time to time. - Prepayment facility is available. Rate of interest on prepayment will be 1%less than the applicable rate for the terms of deposit remained with the bank

- Overdraft/ loan facility Interest rate

Available

– Up to 90% of the deposit amount

– 2% over the deposit rate of interest applicable - Special features:

1. Deposit can be renewed with interest on due date.

2. The principal amount of deposit can be renewed and interest is paid separately to the customer

3. The principal amount and interest due thereon will be paid to the customer on due date.

4. Special rates for deposits of P0.5 mn and above.

5. No cash deposit fee - Other terms and conditions:

If the entire amount is withdrawn within one month from the date of deposit, no interest will be payable on deposit. However, if the deposit remains for a period exceeding one month prepayment may be considered with interest @1% below the rate applicable for the period for which the deposit has remained with the Bank.

Current AccountCurrent Deposit product is ideal for firm, companies, institutions, HUF, individuals etc., who need banking facility more frequently. This is one of the most basic and flexible deposit options, allowing transaction without limiting the numbers.

- Eligibility:

Individual business firm, company, associations, society etc. - Deposit amount:

Minimum P3000

Maximum No Limit - Interest:

No interest is payable in the A/C - Cheque Book Facility:

Available - Overdraft/ loan facility:

Overdraft facility available by arrangement - Special features:

1. Any number of debits and credits are allowed in the account

2. Debits in the account will be allowed without service fees which are related to business or personal loans availed from the Bank and also transfer of funds from one account to another account maintained within Bank of Baroda (Botswana) ltd of the same customer or any other customer. - Sweep in Sweep out facilities:

If the entire amount is withdrawn within one month from the date of deposit, no interest will be payable on deposit. However, if the deposit remains for a period exceeding one month prepayment may be considered with interest @1% below the rate applicable for the period for which the deposit has remained with the Bank. - Service Charges:

As declared by the Bank from time to time

Call AccountThis product is designed for the deposit holders to enable them to deposit funds earn interest, maintain liquidity withdrawal fund as and when needed

- Eligibility:

Individuals, business firms, company, corporate, association, society etc. - Deposit amount:

Minimum P1000

Maximum No Limit - Period:

No minimum or maximum period is stipulated - Rate of interest Rests:

Interest is paid on the outstanding balance in the account on daily basis and is paid on monthly intervals. However, balance less than P1000 does not attract interest - Special features:

1. The customer can deposit money at any time.

2. Withdrawals can be made in multiples of P 1000.

3. No interest is payable if the balance in the account goes below P 1000 at the end of any day during the month.

4. Special rates for deposit amount P0.50 mn and above.

Privilege CurrentA unique deposit product for business customers specially tailor made looking to customer’s requirements with added advantages. Customers having Privilege Current account save a lot on various charges and also earn interest.

- Key benefits:

1. Free statement of account twice in a month.

2. Free signature verification once in three months.

3. Nil folio charges.

4. Free transfer of funds from one account to another account of same branch or other branch within Bank of Baroda (Botswana) Ltd & concession in transfer of salary payment.

5. Free transfer of funds through EFT/RTGS from other banks in Botswana.

6. Free/Concession in cash transaction charges.

7. Sweep in/Sweep out facility available from Current to Call account and vice versa.

8. Free net banking facility.

9. Standing instructions facility available - Eligibility:

Above account can be opened by any individual, firms, companies, trusts, associations, Clubs, societies. - Concession in Cash transaction charges:

1. If minimum balance is maintained BWP 50,000 & above: 50% concession of applicable rate on both for Cash deposit and Cash payment.

2. If minimum balance is maintained BWP 100,000 & above: 100% concession on cash transaction charges both for cash deposit and cash payment. - Sweep in/Sweep out facility:

Sweep in/Sweep out facility is available on balance above BWP 50,000 or BWP 100,000 as per customers requests depending on whether he wishes to avail 50% concession or 100% concession in Cash transaction charges. Customer will earn interest as applicable for Call account. Present rate of interest in Call account is 4.0%p.a. - Other Charges:

Other charges remain as per tariff for normal Current account.

CONTACT

CONTACTWhat Is The Interest Rate On Fd In Bank Of Baroda

FD Calculator Bank of Baroda in India 2019

| Tenure | Rates | Maturity Amount for Rs. 1 Lakh |

| 2 years 1 day to 3 years | 6.70% to 7.20% | Rs. 114,233 – Rs.123,872 |

| 15 days to 45 days | 4.50% to 5.00% | Rs. 100,185 – Rs.100,616 |

| 3 years 1 day to 5 years | 6.70% to 7.20% | Rs. 122,081 – Rs.142,875 |

| 7 days to 14 days | 5.25% to 5.50% | Rs. 100,101 – Rs.100,211 |

| 46 days to 90 days | 4.75% to 5.25% | Rs. 100,599 – Rs.101,295 |

| 91 days to 180 days | 5.50% to 6.00% | Rs. 101,371 – Rs.102,980 |

| 181 days to 270 days | 6.25% to 6.75% | Rs. 103,123 – Rs.105,076 |

| 271 days to 364 days | 6.25% to 6.75% | Rs. 104,712 – Rs.106,903 |

| 1 year | 6.45% to 6.95% | Rs. 106,608 – Rs.107,133 |

| 1 year 1 day to 400 days | 6.60% to 7.10% | Rs. 106,784 – Rs.108,018 |

| 400 days to 2 years | 6.55% to 7.05% | Rs. 107,380 – Rs.115,001 |

| 5 years 1 day to 10 years | 6.45% to 6.95% | Rs. 137,727 – Rs.199,179 |

Bank Of Baroda Interest Rate

Bank of Baroda Fixed Deposit Calculator

Bank of Baroda FD Calculator offers the best interest rates upto 6.70% on its fixed deposits. Use FD Calculator of Bank of Baroda to calculate your maturity amount on the basis of current FD interest rates. Input your investment amount, interest rate & tenure to know your matured amount.This will give the details of investment that’s the principal amount on maturity after the interest is compounded on days or a monthly, quarterly, half-yearly and yearly basis.

- Deposit amount

- Rate of interest

- FD tenure

- Compounding frequency

- TDS applicability and TDS rate

Documents required to open Bank of Baroda FD account

1. Identity proof

- Passport

- PAN card

- Voter ID card

- Driving license

- Government ID card

- Photo ration card

- Senior citizen ID card

2. Address proof

- Passport

- Telephone bill

- Electricity bill

- Bank Statement with Cheque

- Certificate/ ID card issued by Post office

Types of Fixed Deposit offered by Bank of Baroda

Bank Of Baroda Fixed Deposit Interest Rate Calculator

- Fixed/Short Term Deposit– A standard FD scheme offered by Bank of Baroda wherein customers are paid fixed interest amounts at regular intervals.

- Quarterly/Monthly Term Deposit– In this scheme, customers can choose to receive interest payments at monthly or quarterly intervals

- You can also choose to receive payment at the end of the maturity period.